India AMFI Know Your Client (KYC) Application Form (For Individuals Only) 2022-2025 free printable template

Show details

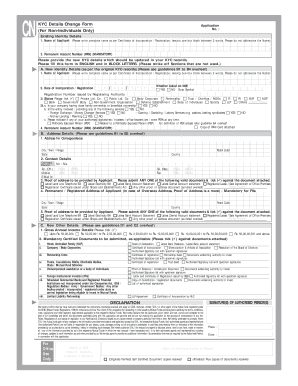

CKY & ERA KYC Form Know Your Client Application Form (For Individuals only) Application (Please fill the form in English and in BLOCK Letters) Fields marked with * are mandatory fieldsLOGONewType×Update

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign in kyc application form

Edit your know your client application form pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your in kyc application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sbi kyc form pdf online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sbi kyc form download. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India AMFI Know Your Client (KYC) Application Form (For Individuals Only) Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (93 Votes)

4.2 Satisfied (86 Votes)

How to fill out sbi kyc updation form pdf

How to fill out India AMFI Know Your Client (KYC) Application

01

Obtain the AMFI KYC application form from the official AMFI website or your financial institution.

02

Fill in the personal details section including name, date of birth, gender, and marital status.

03

Provide your address details including residential and permanent address.

04

Specify your nationality and the country of residence.

05

Fill in the identification details, providing a valid ID proof number like PAN, passport, or voter ID.

06

Submit income details, indicating your annual income range.

07

Provide information about your occupation and source of funds.

08

Attach the required documents, such as a recent passport-sized photograph, proof of identity, and proof of address.

09

Review the application for accuracy and completeness.

10

Sign and date the application where indicated.

11

Submit the completed application to your financial institution or through an authorized agent.

Who needs India AMFI Know Your Client (KYC) Application?

01

Individuals looking to invest in mutual funds in India.

02

Financial advisors and intermediaries facilitating mutual fund transactions.

03

Companies and institutions managing mutual fund schemes.

04

Any resident or non-resident Indian looking to comply with regulatory requirements for financial investments.

Video instructions and help with filling out and completing in kyc application pdf

Instructions and Help about association mutual funds individuals

Fill

kyc form sbi pdf

: Try Risk Free

What is kyc application form?

KYC means Know Your Customer. Investors who want to invest in the market securities need to complete the KYC process. They need to fill the KYC form and submit it to the SEBI registered intermediary such as Asset Management Companies, banks, etc. along with the required KYC documents in order to be KYC compliant.

People Also Ask about sbi kyc form pdf download 2024

What documents required for KYC in SBI bank?

KYC Documents Individuals Passport. Voter's Identity Card. Driving Licence. Aadhaar Letter/Card. NREGA Card. PAN Card.

Where can I download KYC form?

Aadhaar based KYC (eKYC) Process Visit any KRA website and provide the Aadhaar card number. You will receive an OTP (One Time Password) on the registered mobile number. The OTP will internally link and fill up your details in the online KYC form. On successful verification, you will be e-KYC compliant.

Where can I get a KYC form?

An individual can either do this via the financial institution or download the registration form from the KYC Registration Agencies (KRAs) website, fill it in, and submit it alongside the required documents.

Can I submit KYC online for SBI?

Since the Covid-19 and lockdown started across India, SBI bank has started accepting KYC documents online. The bank has confirmed that the KYC updation shall be carried out based on documents received from customers through post or registered email.

How to do KYC online for NRI?

NRIs need to enter their account number on the official website of the banks they have an account with, followed by captcha validation. Upload their valid passport. Upload documents issued by foreign government departments (VISA, Resident permit, etc.) Upload PAN Card or Form 60 if PAN is not available.

How can I update my SBI KYC online for NRI?

The best way to modify Sbi kyc form for nri online Register and log in to your account. Sign in to the editor using your credentials or click Create free account to examine the tool's features. Add the Sbi kyc form for nri for redacting. Alter your file. Finish redacting the form.

Where can I download KYC certificate?

You can check your KYC status on CAMS website by entering your PAN Number. But it only offers your KYC status, not a copy of your KYC. If you have doubts about what the other person has filled in your KYC, download a KYC form from the site and update the information by filling all the relevant details.

How do I request a KYC document?

To do so, you can choose to visit a KYC kiosk, or mutual fund house and authenticate your identity using Aadhar biometrics. You can also call the KYC registration agency to send an executive to your home or office to carry out this verification.

Can I get KYC form online?

If you do not have the time to go through the KYC procedure offline and wondering if KYC can be done online, the answer is 'YES'. e-KYC eliminates physical paperwork and in-person verification that is needed in case of regular KYC registration.

Is KYC form free?

Banks or credit unions can use this free Account Opening Form to quickly gather new clients' contact details, salaries, and addresses.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit sbi kyc form pdf download from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including sbi kyc form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I edit sbi kyc updation form pdf download on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing association mutual funds individuals search, you need to install and log in to the app.

How do I fill out association mutual funds individuals get on an Android device?

Complete sbi kyc form image and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is India AMFI Know Your Client (KYC) Application?

The India AMFI Know Your Client (KYC) Application is a regulatory process designed to verify the identity of investors before allowing them to make investments in mutual funds in India. It ensures that financial institutions have necessary information about their clients.

Who is required to file India AMFI Know Your Client (KYC) Application?

Any individual or entity intending to invest in mutual funds in India is required to file the India AMFI Know Your Client (KYC) Application. This includes retail investors, corporates, and institutions.

How to fill out India AMFI Know Your Client (KYC) Application?

To fill out the India AMFI Know Your Client (KYC) Application, an applicant must provide personal details, documentary proof of identity and address, and any other required information as specified by the AMFI guidelines. This can usually be done online or via physical forms at designated centers.

What is the purpose of India AMFI Know Your Client (KYC) Application?

The purpose of the India AMFI Know Your Client (KYC) Application is to prevent fraud, money laundering, and terrorist financing by ensuring that financial institutions verify the identity of their clients before conducting transactions.

What information must be reported on India AMFI Know Your Client (KYC) Application?

The information reported on the India AMFI Know Your Client (KYC) Application typically includes the applicant's name, address, date of birth, occupation, PAN (Permanent Account Number), and proof of identity and address through specified documents.

Fill out your India AMFI Know Your Client KYC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kyc Details Updation Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to sbi e kyc form pdf

Related to yono sbi kyc form pdf download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.